The Great Depression, a profound economic downturn in the 1930s, is often shrouded in misconceptions and myths. These myths can obscure the true lessons to be learned from this pivotal period in history.

By debunking these myths, we gain a clearer understanding of the economic, political, and social dynamics of the time.

This blog post aims to unravel the truth behind 13 common myths associated with the Great Depression, providing insights that remain relevant today.

Myth 1: The Stock Market Crash Caused the Depression

Many believe the stock market crash of 1929 directly caused the Great Depression. While it certainly had a significant impact, the crash was more a symptom than a cause.

It shattered investor confidence and wiped out fortunes, but the economic downturn was already brewing. Structural weaknesses in the economy, such as overproduction and underconsumption, played crucial roles.

Additionally, the banking sector’s instability and poor monetary policy exacerbated the situation. Understanding these underlying factors provides a more nuanced view of the Depression’s origins, beyond the dramatic scenes of Wall Street’s downfall.

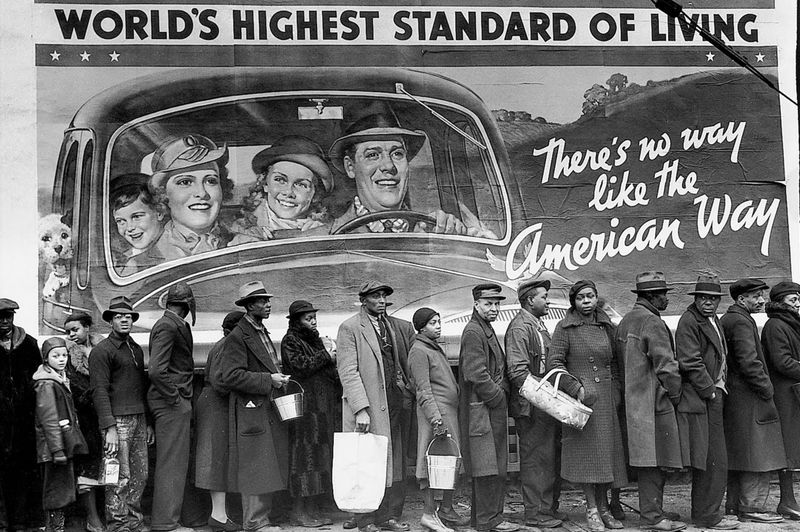

Myth 2: The Depression Affected All Americans Equally

The Great Depression did not impact everyone in the same manner. While many suffered extreme poverty, some segments of society managed to maintain or even increase their wealth.

Wealthy individuals and those in stable industries often weathered the storm better than others. For instance, industries like film and entertainment thrived as people sought inexpensive escapism.

However, minority groups and rural communities often faced harsher conditions and longer recovery periods. This disparity highlights the unequal distribution of hardships during this era, challenging the myth of a universally shared economic experience.

Myth 3: The New Deal Ended the Depression

The New Deal, introduced by President Franklin D. Roosevelt, tackled many issues but did not end the Depression. It provided relief to millions and reformed significant sectors, including banking and labor.

However, the economy remained sluggish throughout the 1930s. It wasn’t until World War II, with its surge in production and employment, that the economy truly recovered.

The New Deal’s legacy lies in its lasting reforms and the safety nets it established, which continue to benefit society. Thus, while transformative, it was not the ultimate solution to the economic crisis.

Myth 4: The Depression Only Affected the United States

Contrary to popular belief, the Great Depression was a global phenomenon. Countries across Europe, Asia, and South America experienced severe economic downturns.

The interconnectedness of world economies meant that the U.S. crash had far-reaching implications. For example, Germany faced heightened political instability, which contributed to the rise of extremism.

In Asia, countries like Japan saw shifts towards militarization as a response to economic pressures. Understanding the global impact of the Depression reveals its widespread consequences, influencing international relations and economic policies for decades to come.

Myth 5: Hoover Did Nothing to Combat the Depression

Herbert Hoover, often criticized for inaction, did attempt various measures to combat the Depression. His administration implemented public works projects, such as the Hoover Dam, to stimulate the economy.

Hoover also established the Reconstruction Finance Corporation to provide emergency loans to banks and businesses. However, his efforts were largely seen as too little, too late and failed to restore confidence.

Political and public opinion quickly turned against him. Nevertheless, Hoover’s initiatives laid groundwork for future policies and highlight the complexities of leadership during economic crises.

Myth 6: Everyone Lost Their Savings During the Depression

While bank failures were rampant, not everyone lost their life savings during the Great Depression. Many people kept their money in sound institutions or withdrew funds before banks collapsed.

Additionally, government interventions and the creation of the Federal Deposit Insurance Corporation (FDIC) in 1933 helped restore trust in the banking system.

While some undoubtedly suffered devastating financial losses, others managed to preserve their wealth through diversified investments or by keeping cash reserves.

This myth overlooks the varied financial experiences people had during this turbulent period.

Myth 7: The Dust Bowl Was the Sole Cause of Agricultural Decline

The Dust Bowl, infamous for its devastating dust storms, was not the sole cause of agricultural decline during the Great Depression.

While it severely affected farming communities in the Great Plains, other factors also contributed. Over-farming and poor land management practices had already depleted soil fertility.

Moreover, plummeting crop prices due to overproduction and reduced consumer purchasing power compounded farmers’ woes.

Government programs eventually provided relief, but the agricultural sector’s struggles highlight the multiple challenges beyond climatic conditions that farmers faced in this era.

Myth 8: Prohibition Ended During the Depression Because of Economic Pressure

The repeal of Prohibition in 1933 is often attributed to economic necessities, yet it was primarily driven by public opinion and political pressure. The 18th Amendment had not only failed to eliminate alcohol consumption but also fueled organized crime.

As the Depression intensified, calls for repeal grew louder, emphasizing the potential tax revenue from legal alcohol sales. However, the shift was more about correcting a failed policy than direct economic relief.

The repeal’s impact was significant but symbolized a broader recognition of Prohibition’s shortcomings rather than a purely economic decision.

Myth 9: Urban Areas Were Hit Harder Than Rural Ones

The notion that urban areas suffered more than rural ones during the Great Depression is misleading. While cities saw high unemployment and homelessness, rural areas faced severe hardships too.

Farmers struggled with low crop prices and debt, leading to widespread foreclosures. The Dust Bowl further devastated agricultural regions.

Urban workers had a slight advantage in accessing relief programs and public works jobs, whereas isolated rural communities often lacked such support. This myth underestimates the widespread and varied impacts of the Depression, reshaping both urban and rural landscapes.

Myth 10: Unemployment Was the Only Major Issue

While massive unemployment was a glaring issue during the Great Depression, it wasn’t the only major problem. Economic instability led to widespread poverty, homelessness, and hunger.

Additionally, psychological effects, such as despair and a loss of dignity, plagued many. Public health suffered as people couldn’t afford medical care. Social unrest grew, with protests and strikes becoming common.

These multifaceted challenges required comprehensive responses beyond merely addressing unemployment. Recognizing the broader spectrum of issues provides a fuller understanding of the Depression’s profound impact on society.

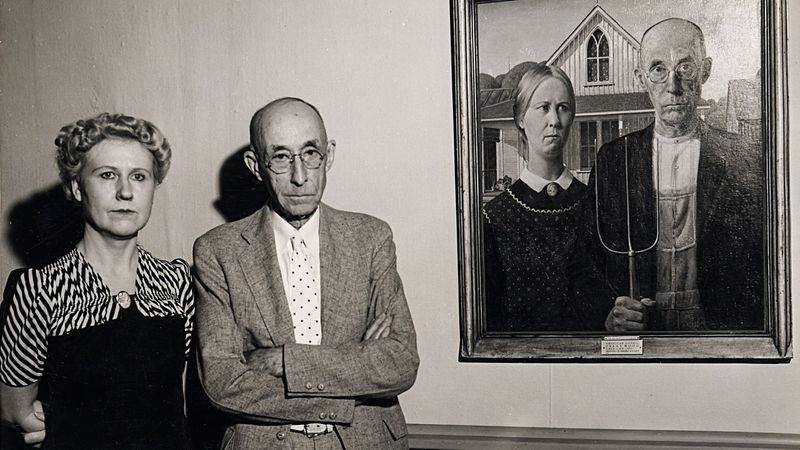

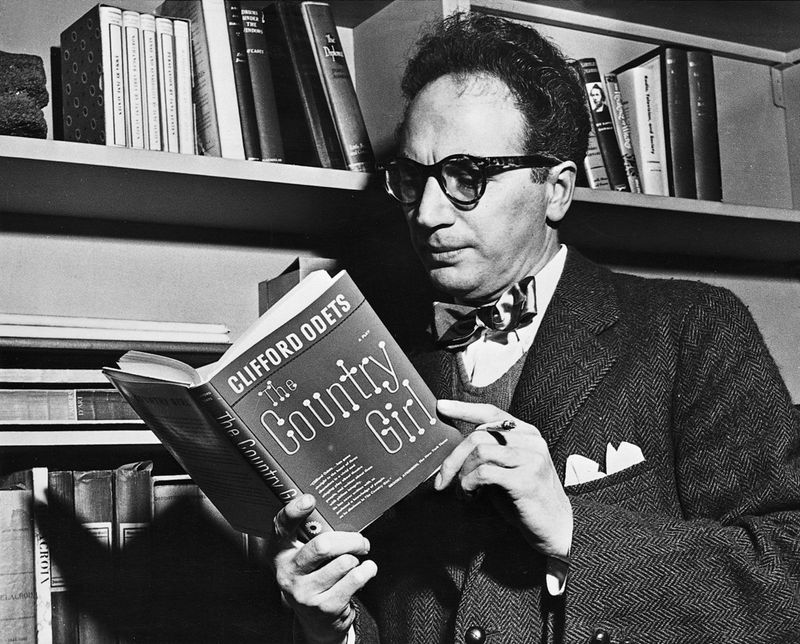

Myth 11: The Depression Was an Era of Cultural Stagnation

Despite economic hardships, the Great Depression was not a period of cultural stagnation. In fact, it was a time of significant artistic and cultural development.

The film industry flourished, producing iconic movies that provided an escape from daily struggles. Literature and music also thrived, with works that captured the era’s spirit.

The Federal Art Project supported thousands of artists, leading to a burst of creativity and innovation. These cultural advancements offered solace and inspiration, proving that economic adversity couldn’t stifle human creativity and expression.

Myth 12: The Federal Government Had No Role in the Economy Before the Depression

It’s a misconception that the federal government was uninvolved in the economy before the Great Depression.

In reality, the government had engaged in various economic activities, including tariffs, war debt policies, and agricultural price controls. However, the Depression marked a significant shift towards more direct intervention, exemplified by New Deal programs.

This era paved the way for the modern welfare state and regulatory frameworks. Understanding this evolution clarifies the government’s expanding role during crises and its impact on future economic policies.

Myth 13: Lessons From the Depression Are No Longer Relevant

The belief that lessons from the Great Depression are outdated is misguided. Many insights from this era remain relevant, particularly in understanding economic cycles, government intervention, and social welfare systems.

The Depression highlighted the importance of financial regulations and safety nets to prevent similar crises. Moreover, studying this period helps us recognize the signs of economic instability and the necessity for proactive measures.

As economic challenges persist, the Great Depression continues to offer valuable lessons for policymakers, economists, and citizens alike.